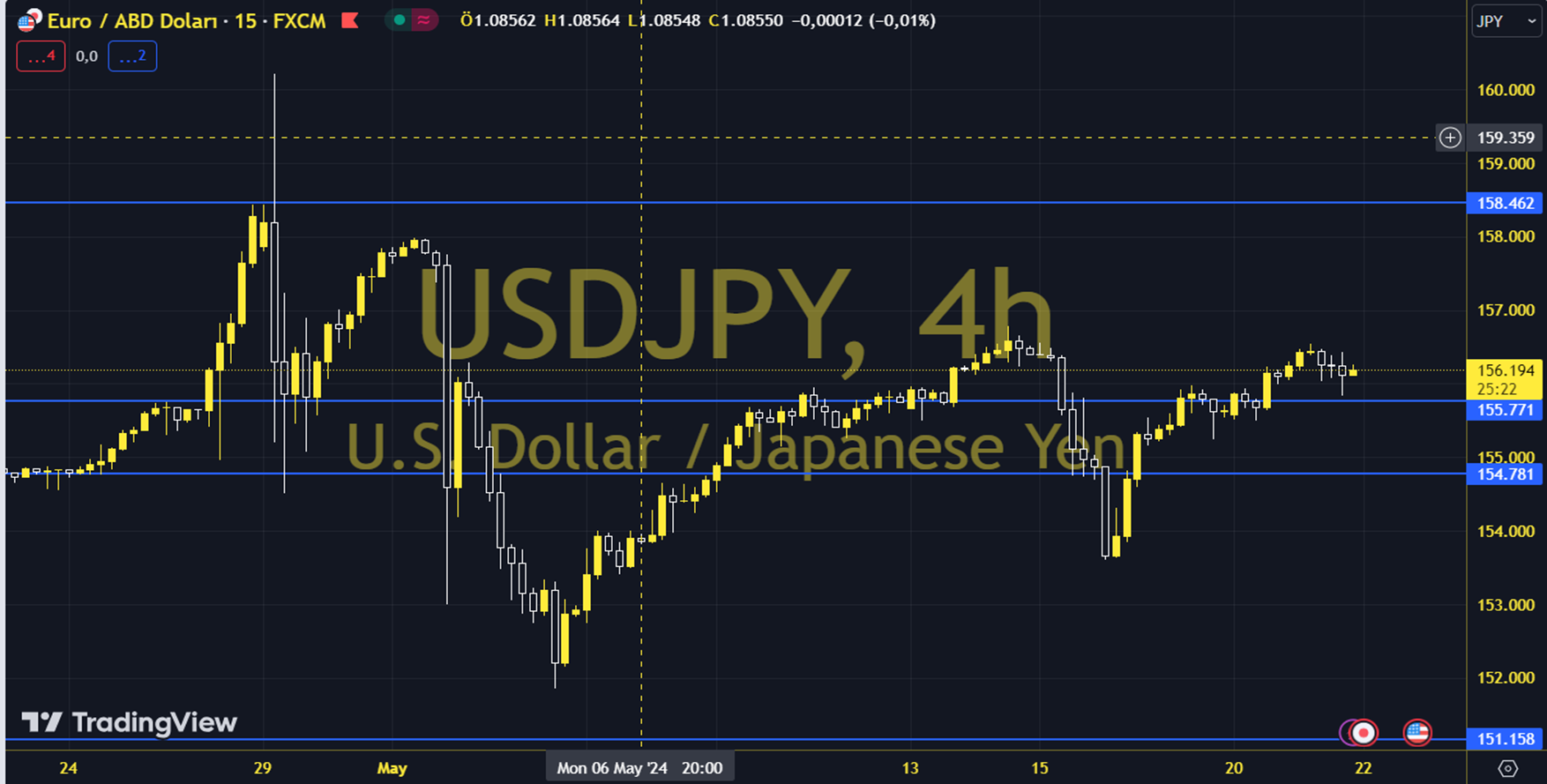

USDJPY

The Japanese Yen (JPY) lost value for the fourth consecutive session on Tuesday, driven by the significant interest rate differential between Japan and the US (US). This pressure on the JPY supported the USD/JPY pair. Market sentiment suggests that the Bank of Japan (BoJ) may raise interest rates earlier than expected against the weak Japanese Yen. The pair, which closed at 156.31 on the previous trading day, gained 0.10% on the day. The RSI indicator for the pair, which is above its 20-day moving average, is at 58.49, while its momentum is at 101.56. The 156.26 level can be followed in intraday downward movements. If this level is broken, supports at 156.17, 156.02 and 155.93 may become important. In possible increases, resistance levels at 156.40, 156.49 and 156.63 will be monitored. Support: 156.170 – 156.020 Resistance: 156.400 – 156.490