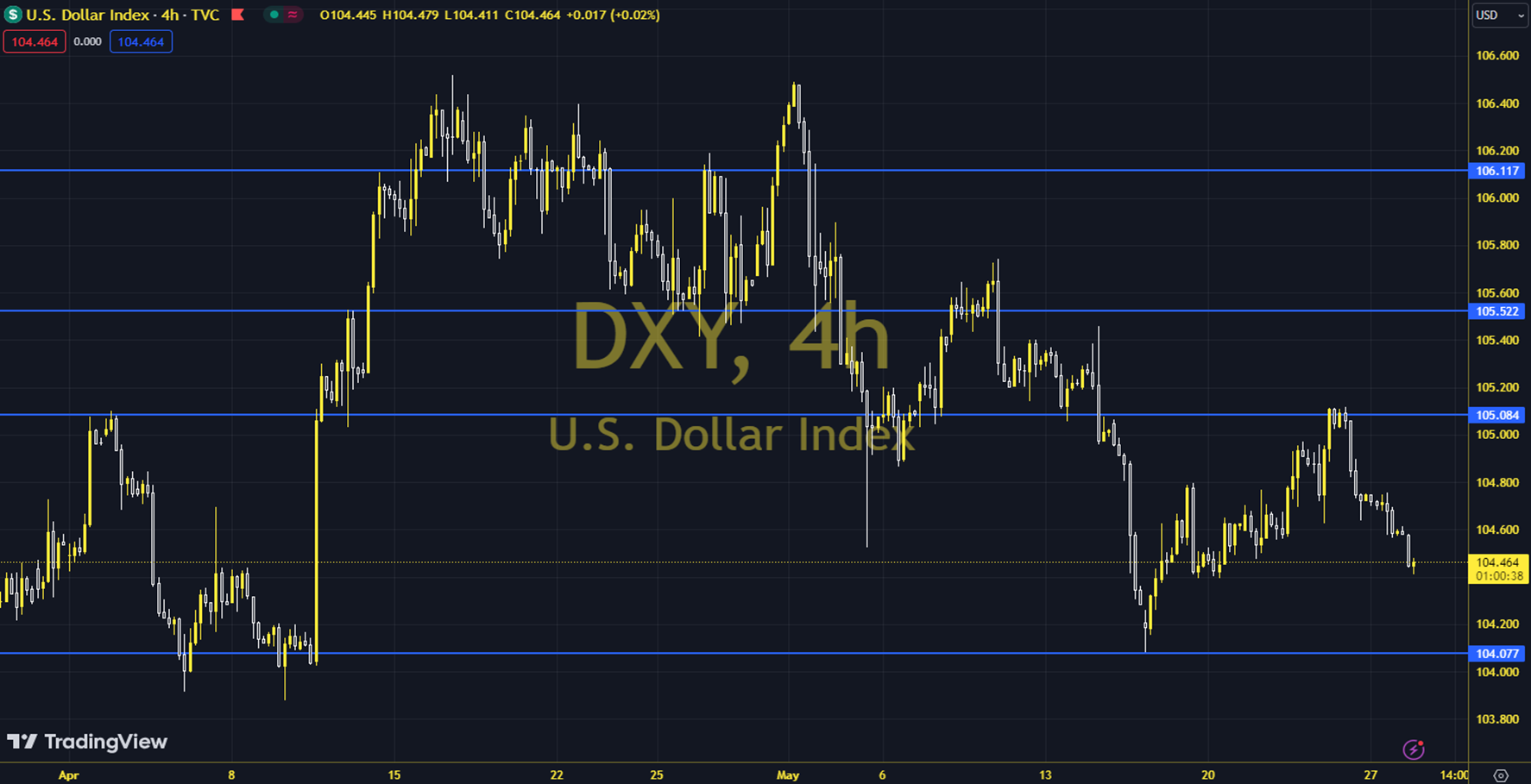

DXY

The Classic Dollar Index, which drew attention with its negative pricing behavior after the US ISM Manufacturing PMI data that fell below expectations and increased the pace of contraction yesterday and took an important step in ending the upward trend view, should be followed carefully in order to answer the question of whether it is serious in its intention. The reaction it will give to the news flows that we will follow throughout the week should be carefully monitored. Psychologically, 105, theoretically, 34 and 100-day averages (104.33 - 104.65 region) can now be explained as a significant resistance and a strong resistance in order to create pressure for the new appearance of the index. The 103.960 level can be followed in intraday downward movements. If this level is broken, the supports at 103,730 and 103,590 may become important. In case of possible increases, the resistance levels at 104,330 and 104,650 will be monitored. Support: 103,960-104,730 Resistance: 104,330-104,650