Famous investor Rogers: I need to start investing in Turkish assets again

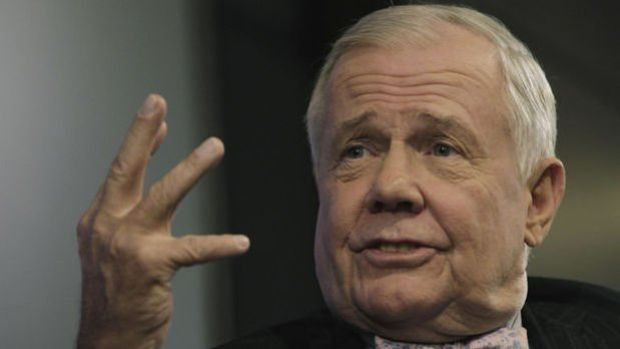

American investor Rogers expects international investment in Turkey to increase with the steps taken in the economy. American investor and finance expert Jim Rogers, known as the "investment guru" in international markets, stated that Turkey has changed its economic policies and that many international investors are following this, and said, "Foreign investors will return, but it will take some time. If Turkey is taking the right steps right now, it will be a very good investment." Answering questions from AA correspondent regarding developments in the Turkish economy, Rogers explained that he has invested in Turkish assets several times in different periods of his life, but that he does not currently have any investments in Turkish assets. Stating that he has not made any investments because he has not been following the Turkish market for a while, Rogers continued as follows: "However, maybe I need to start (investing in Turkish assets) again. Foreign investors will return with Turkey changing its economic policies, but it will take some time. Many international investors are currently following what Turkey is doing. Investors will return with Turkey taking reasonable steps economically. If Turkey is taking the right steps right now, it will be a very good investment." Rogers, who said that investors want to see regulations and reforms implemented and therefore closely follows the steps taken, said, "Now I know that I need to look at the Turkish market again. Me and other investors should start investing in the Turkish market again." "I moved away from US assets, Chinese assets are very cheap" Also evaluating US and Chinese stocks, Rogers stated that US stocks are at an all-time high and could rise even higher, saying, "But when a stock is very high and problems such as inflation and interest rates start to occur, you move away from stocks. I moved away too." Rogers stated that assets are cheap in China, which has a major housing problem and is still experiencing the effects of the Covid-19 outbreak, and said, "Right now, China is cheap, the market is low. I prefer to look at the market that is low rather than high