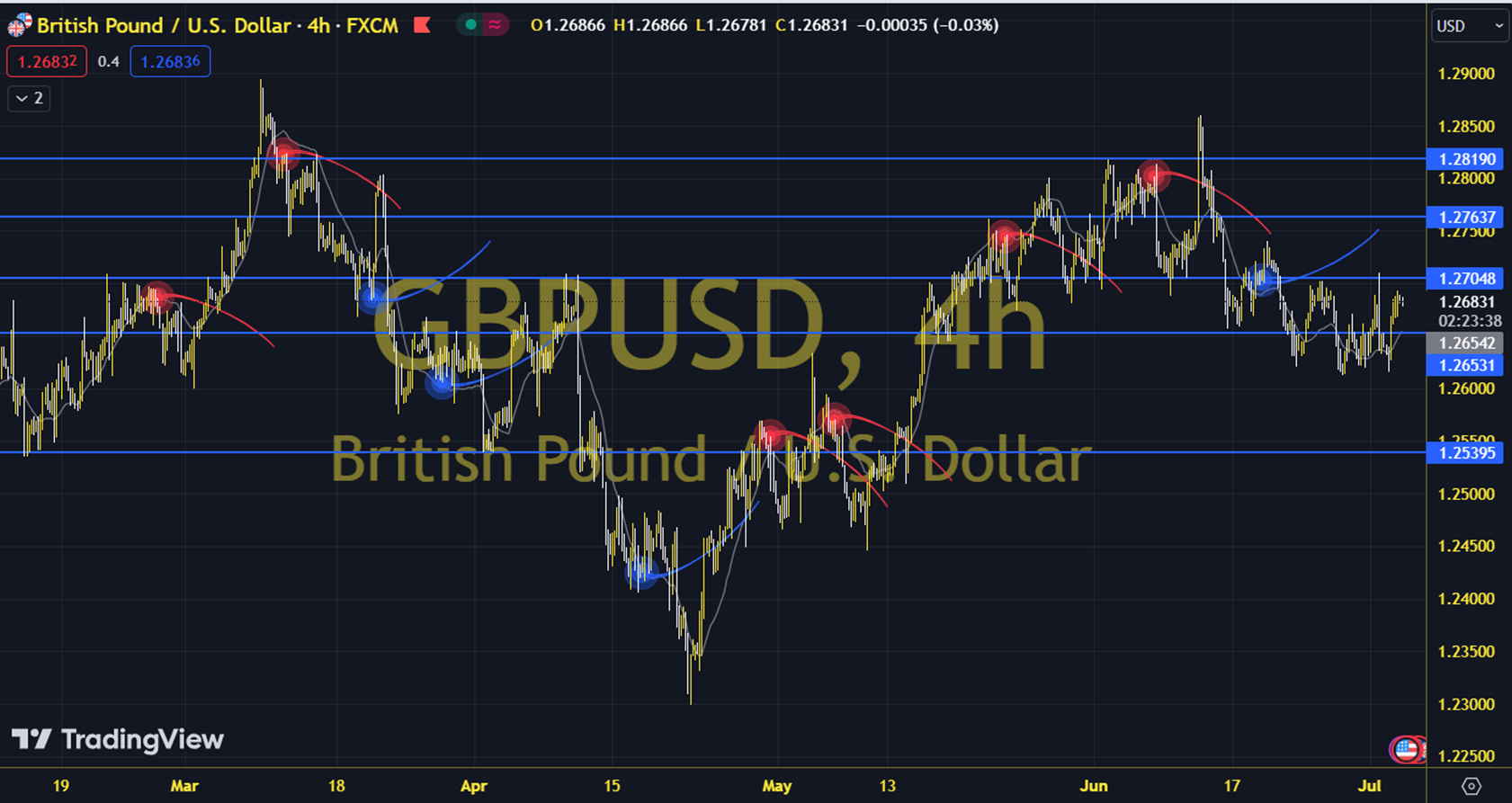

GBPUSD

While the presentation that Fed Chair Powell will make first in the Senate and then in the House of Representatives and the Consumer Inflation data for June from the US are seen as the most important topics to be followed between Tuesday and Thursday, both the messages that the President will give and the latest developments in inflation should be followed carefully to answer the question of whether the Fed's 2nd interest rate cut is supported. The daily gain for the parity that closed at 1.2806 on the previous trading day was 0.00%. The RSI indicator for the parity, which is below its 20-day moving average, is at 63.40, while its momentum is at 101.32. The 1.2817 level can be followed in intraday upward movements. If this level is exceeded, the 1.2827 and 1.2837 resistances may become important. In possible pullbacks, 1.2797, 1.2787 and 1.2777 will be monitored as support levels. Support: 1.2797 – 1.2787 Resistance: 1.2817 – 1.2827