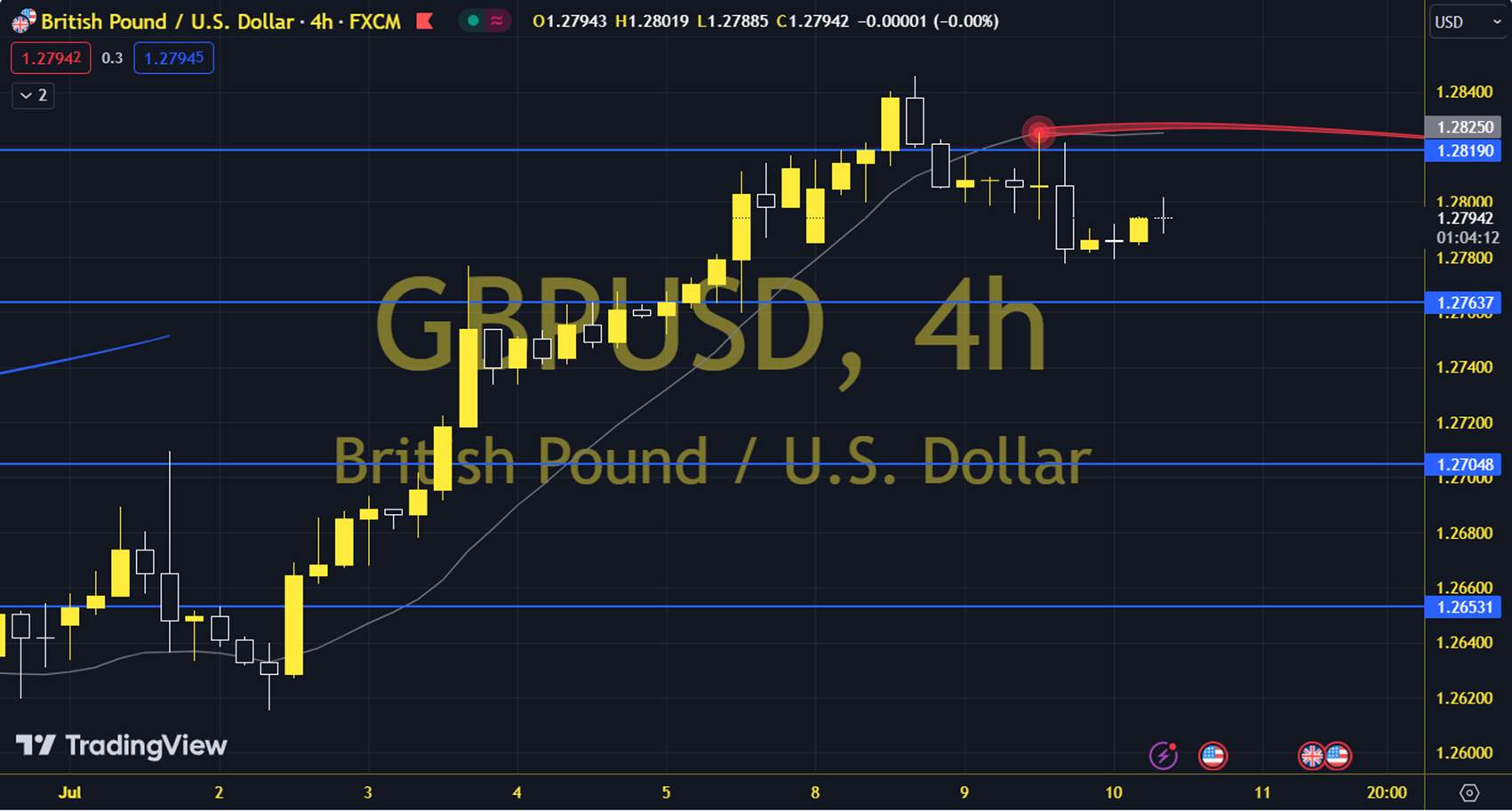

GBPUSD

Despite the nonfarm payrolls data coming in above expectations on Friday, with the slowdown in wage growth and the increase in unemployment, we observe that the probability of a September Fed rate cut is 68% on the CME FedWatch side, 70% after Fed Chair Powell's presentation in the Senate and 70% right now before the critical US CPI data. Although the Fed is making cautious statements, the markets are willing to make an additional rate cut, but this idea needs to be supported. Today, there is the June CPI data from the US. The daily gain for the parity, which closed at 1.2858 on the previous trading day, was 0.07%. The RSI indicator for the parity, which is below its 20-day moving average, is at 66.88, while its momentum is at 101.37. The 1.2849 level can be followed in intraday downward movements. If this level is dropped, the 1.2839 and 1.2831 supports may become important. In possible increases, 1.2867, 1.2875 and 1.2885 will be monitored as resistance levels. Support: 1.2849 - 1.2839 Resistance: 1.2867 - 1.2875