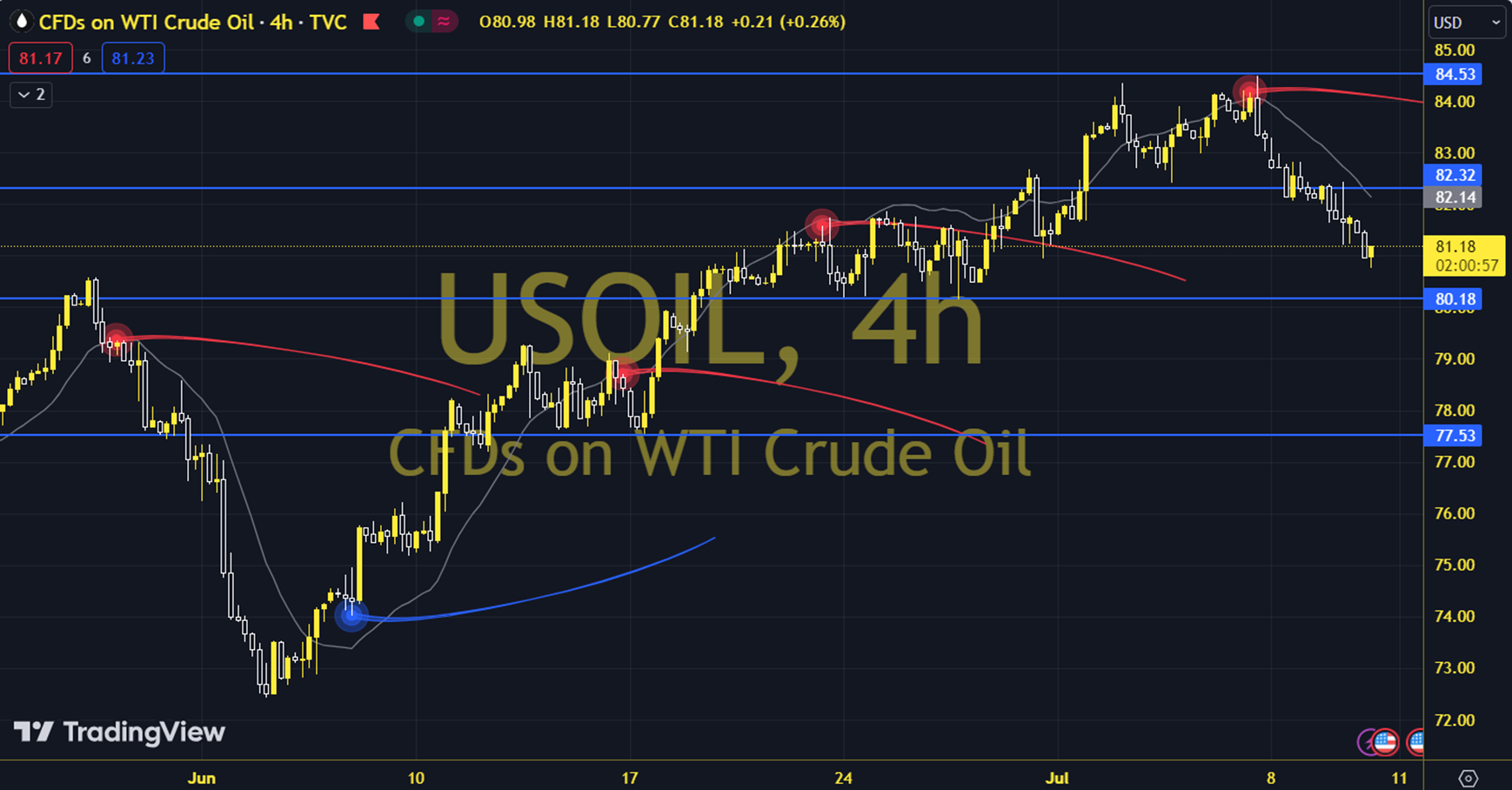

WTIUSD

Oil futures showed a recovery trend with the Energy Information Administration report showing that demand for oil derivatives gained strength during the July 4 holiday in the US. Gasoline demand is at its highest level since the pandemic, according to the 4-week average. The institution, which announced a 3.4 million barrel decrease in stocks yesterday, also showed that stocks in Cushing, a futures delivery center, reached their lowest levels in about 2.5 months. The course of European and US stock markets and US June inflation data can be followed during the day. On the WTI side, an upward trend parallel to Brent oil is also dominant. WTI oil saw a high of 82.85 and a low of 81.15 on the previous trading day. The 82.21 level can be followed in intraday downward movements. If this level is broken, the supports of 81.57 and 80.81 may become important. In possible increases, 83.26, 83.90 and 84.95 will be monitored as resistance levels. Support: 82.21 – 81.57 Resistance: 83.26 – 83.90