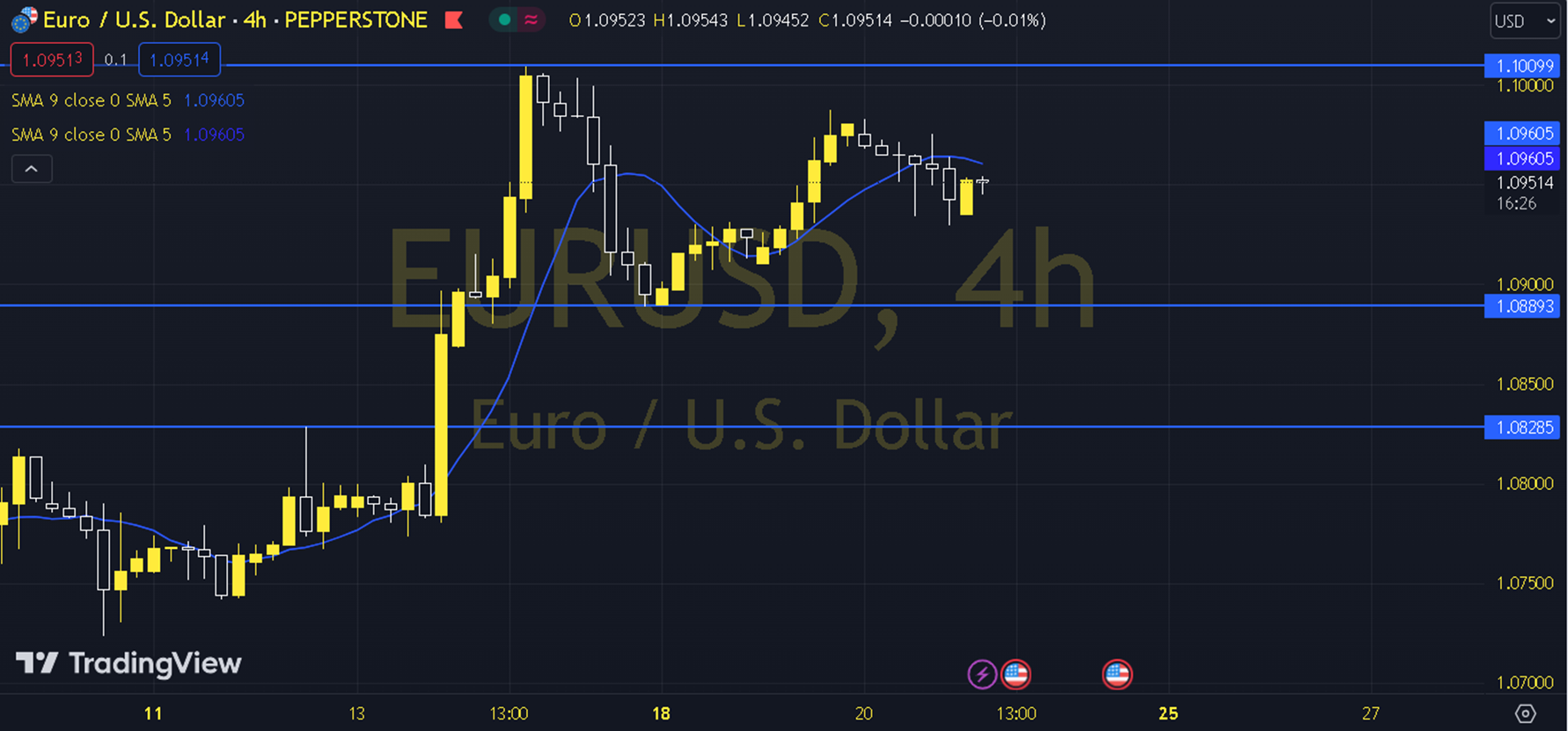

EURUSD

While the optimism in the markets continues for EURUSD before the Christmas holiday, the US PCE Deflator data on Friday will be the most important agenda item of the week, and today the Final Growth and Unemployment Benefit Applications from the US can be followed. When we evaluate the EURUSD parity in the short term, the 1.0890 region where the 55-period average is located is important, and the parity may want to continue its upward trend above the relevant average. With this in mind, pricing can be monitored towards the 1.1008 and 1.1050 barriers, especially 1.0965. In the possible reaction idea, the 55-period average is the main support, and it should not be forgotten that as long as we do not observe a dramatic pricing, it will continue positively, but permanent movements below the average are needed for the current scenario to be considered invalid. However, under this condition, a new pressure towards the 1.0715 – 1.0755 bottom region can be observed. Support: 1.0890 – 1.0855 Resistance: 1.1050 – 1.1090