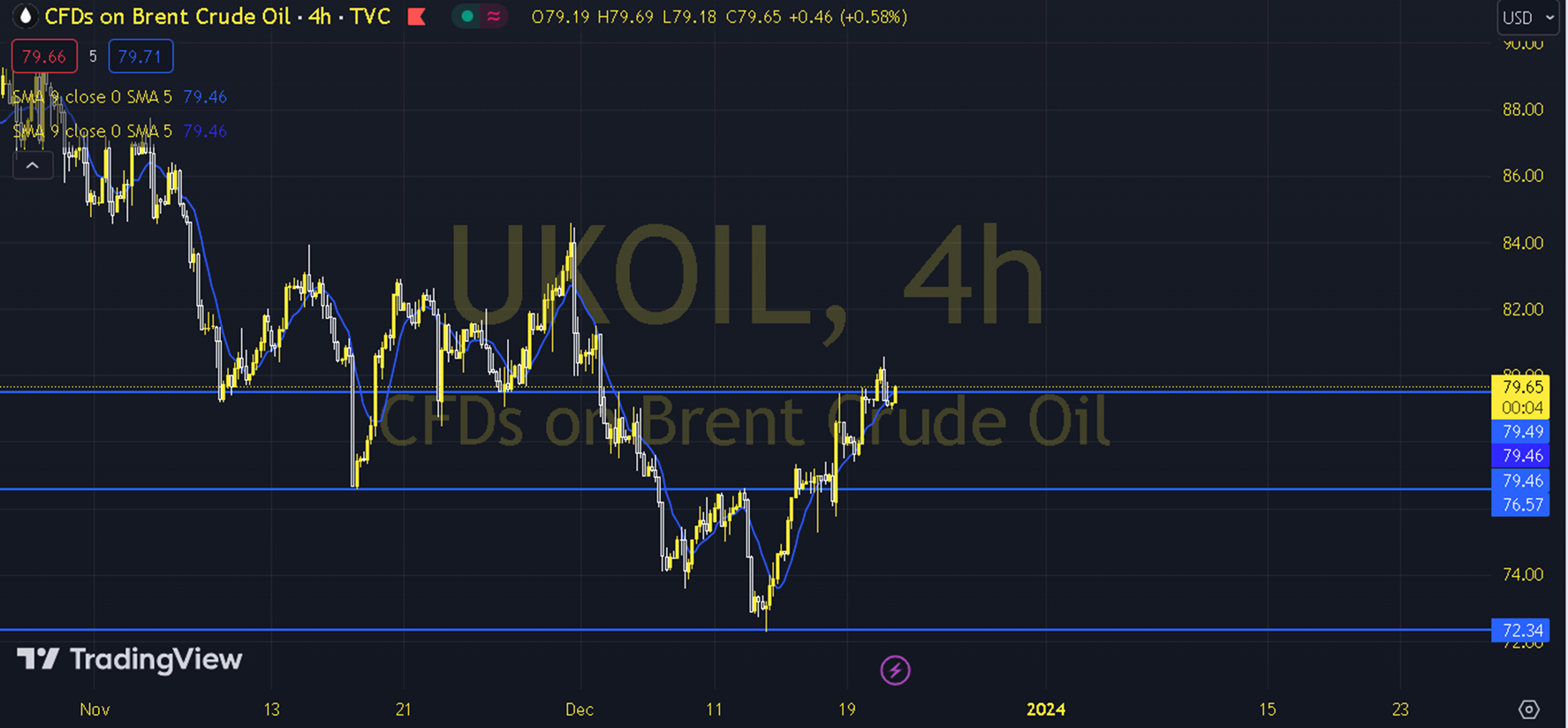

BRENT

Following the disruption of Red Sea shipments and the fact that some ships began to prefer longer routes, rising oil prices were subject to profit taking again yesterday, testing the limit of the trend we have indicated in the chart. The US Energy Information Administration's announcement of a 2.9 million barrel increase in stocks also supported this picture. The course of European and US stock exchanges and the data flow on the US side can be followed during the day. In the upcoming period, pricing and hourly closings that may occur outside the 79.00 - 79.50 region where the averages are concentrated may clarify the search for direction. The desire for an increase may come to the fore with the course and hourly closings above 79.50. In this case, the levels of 80.00 and 80.50 can be targeted. In possible declines, the attitude of the 79.00 support can be followed. The breakdown of this support and hourly closings that may occur in the region may bring the levels of 78.50 and 78.00 to the agenda. Support: 78.50 Resistance: 80.50