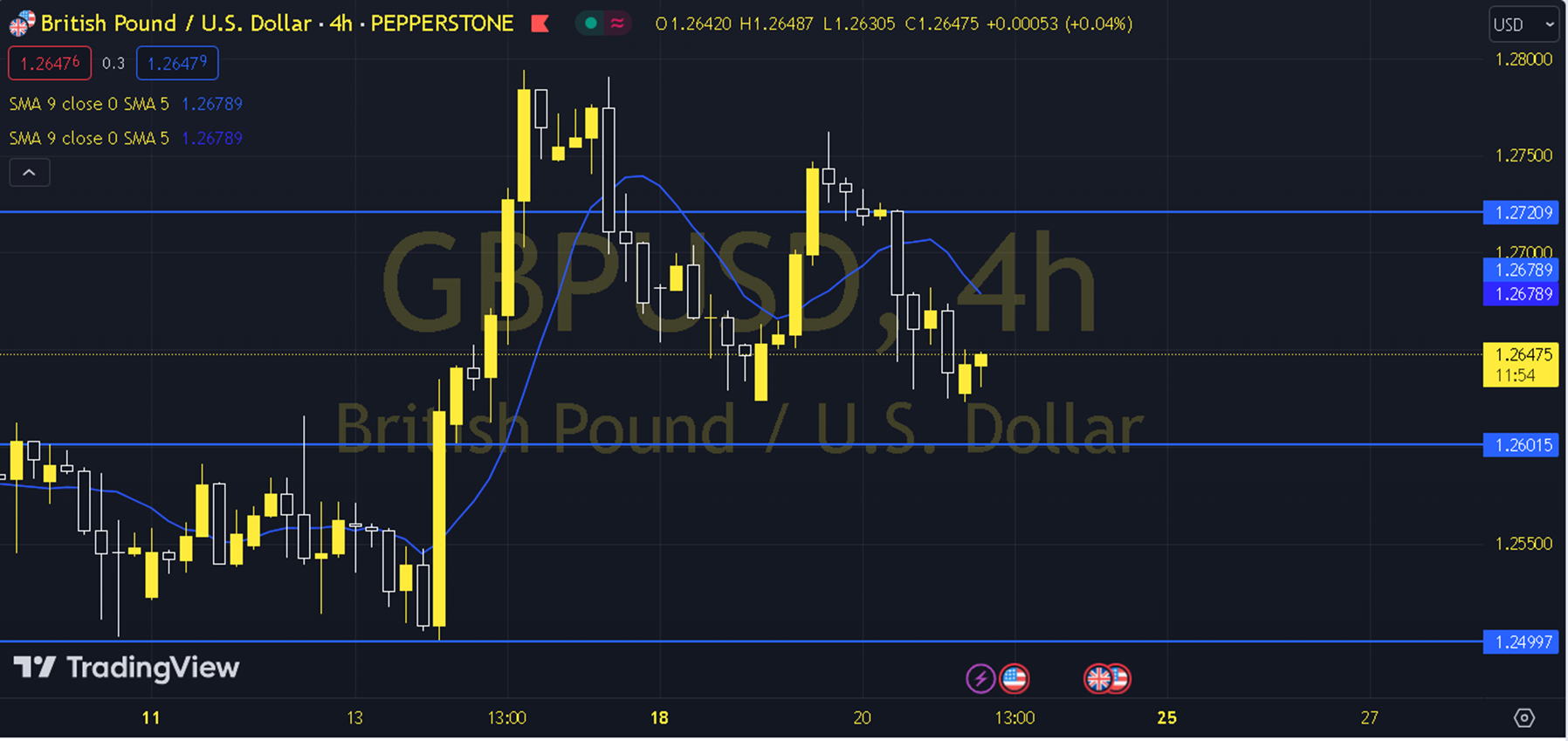

GBPUSD

GBPUSD parity The inflation data below expectations in the UK and the revision of the first discount date to May on the BoE front caused an intraday price divergence between the Euro and the Sterling. When we evaluate the GBPUSD parity in the short term, the 1.2520 - 1.2560 region where the 200-period average is located is important, but the parity may want to continue its upward trend above the relevant average. With this in mind, pricing can be monitored towards the barriers of 1.2665, 1.2730 and 1.2782. In particular, permanent movements above the 34-period average of 1.2665 may allow the trend-oriented view to continue, and in case of pressure, the reaction idea to remain in the foreground. In light of the inflation data below expectations and recent movements, the reaction idea is in the foreground. However, it should not be forgotten that the outlook on the main average is positive. Support: 1.25650 Resistance: 1.27300