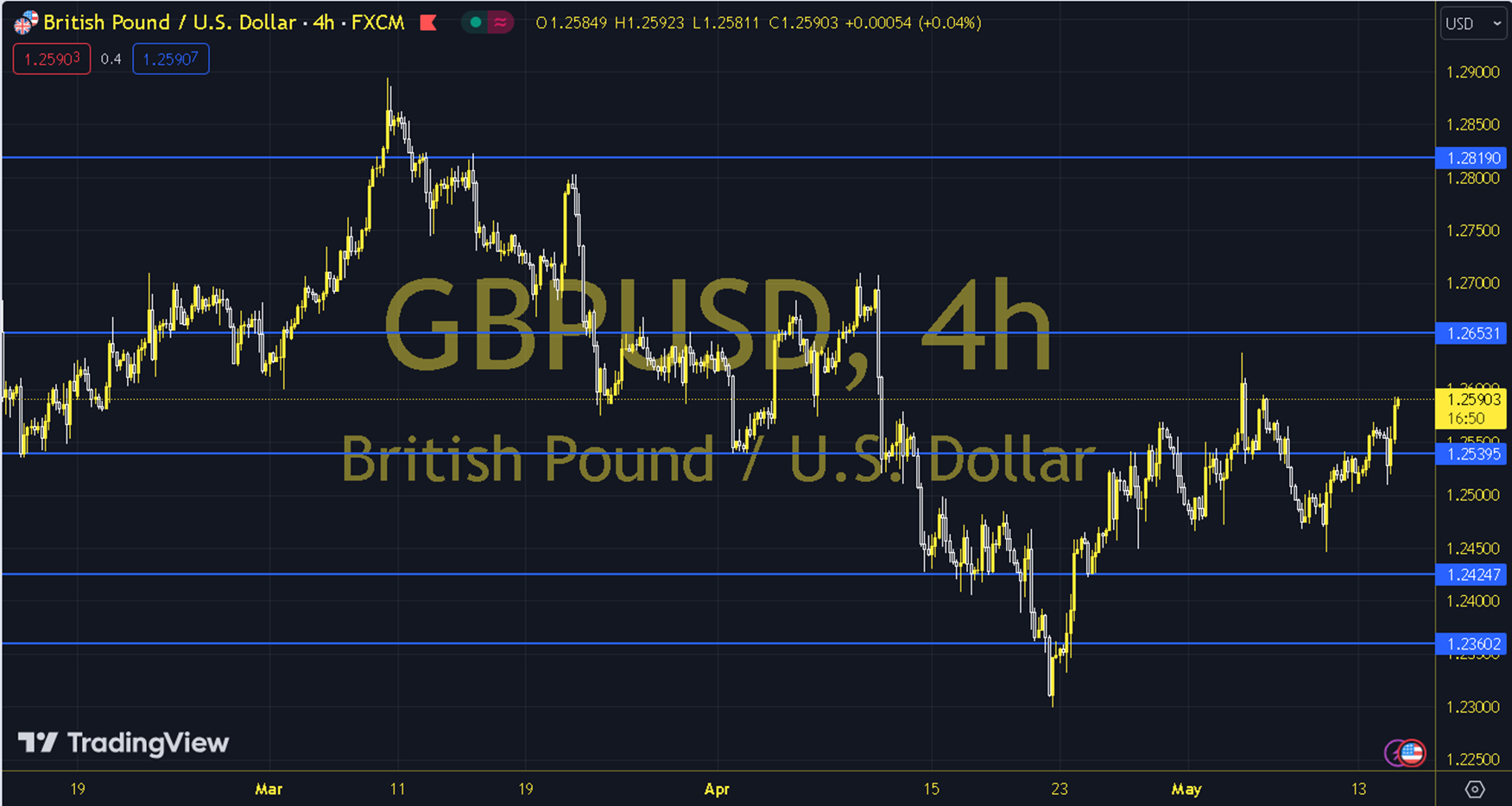

GBPUSD

The countdown has begun for the US CPI data, which is the main focus of global markets. The reference indicators Dollar Index and US Bond Interest Rates may follow a dynamic course with the CPI data. Therefore, significant changes may be seen in the instant reaction in the parities. The classic Dollar Index keeps the idea of a reaction below the 34-day average (104.98) on its agenda before the critical CPI data. Today, the relevant reactions are seeking an answer to the question of whether they will continue to the 100-day average (104.28) or whether the current trend will continue above the 34-day average. EURUSD and GBPUSD parities are following a course that supports the short-term declines in the index with a positive reaction. The 1.2592 level can be followed in intraday downward movements. In case of falling below this level, the supports of 1.2584, 1.2575 and 1.2567 may become important. In possible increases, 1.2601, 1.2609 and 1.2618 will be monitored as resistance levels. Support: 1.2584 - 1.2575 Resistance: 1.2601 - 1.2609