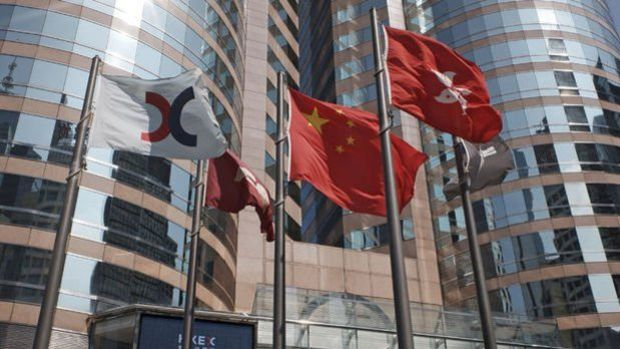

Hong Kong raises interest rates after Fed

Following the 50 basis point hike by the US Federal Reserve (Fed), the Hong Kong Special Administrative Region of China increased its benchmark interest rate by the same percentage due to its exchange rate regime tied to the US dollar. In a statement from the Hong Kong Monetary Authority (HKMA), the region’s de facto central bank, it was announced that the benchmark interest rate was increased by 50 basis points to 4.75 percent. The US Federal Reserve raised its short-term policy rate by 50 basis points to 4.25-4.50 percent yesterday. The Fed’s seventh rate hike of the year brought the interest rate to its highest level in 15 years. The Fed had increased interest rates by 25 basis points in March, 50 basis points in May, and 75 basis points in June, July, September, and November. The HKMA had followed the Fed’s decision in all increases and raised the benchmark interest rate by the same percentage. Hong Kong’s currency, the Hong Kong dollar, was pegged to the U.S. dollar in 1983, and the territory has followed the Fed’s lead in monetary policy. “The public should be ready for higher deposit and loan rates. Citizens should carefully consider their decisions about purchasing property, mortgages and other borrowing,” HKMA Chief Executive Eddie Yue Wai-ma said, noting that inflation was still above the Fed’s 2 percent target and that interest rates could rise further. “The public should be ready for higher deposit and loan rates. Citizens should carefully consider their decisions about buying real estate, taking out property loans and other borrowing.” Interest rates higher than during 2008 financial crisis Following the increases, interest rates in Hong Kong have reached levels higher than during the global financial crisis of 2008. The territory’s benchmark interest rate was last increased to 3.75 in March 2008. Hong Kong banks are expected to raise their base lending rate by 25 basis points following the hike. Banks raised their base lending rate by 12.5 basis points in September and 25 basis points in November due to rising borrowing costs. Interbank borrowing rates also rose to their highest level in 14 years. According to data from the Hong Kong Banks Association, the Hong Kong Interbank Offered Rate (Hibor) reached 4.89 percent monthly, 5.4 percent for three months and 5.78 for 12 months. Accelerating inflation had increased the pressure on the Fed The tone of the Fed’s monetary policy had begun to change in the last quarter of 2021 with the pressure of high inflation that came with the rapid economic recovery following the Covid-19 outbreak in the US. Inflation, which continued to trend upward due to the increase in supply chain problems caused by the policies aimed at controlling the Covid-19 outbreak triggered by the Russia-Ukraine War and the Omicron variant in China, had further increased the pressure on the Fed. The Fed, which started raising interest rates by completing its asset purchase operation in March in the face of high inflation, decided to increase interest rates for the first time since 2018 with an increase of 25 basis points at its March meeting. After the Fed made its fastest rate hike since 2000 at its May meeting by 50 basis points, it made its strongest rate hike since 1994 at its June meeting by 75 basis points, and raised the policy rate by the same amount at its July, September and November meetings. With the latest increase, the Fed has raised interest rates by a total of 425 basis points since March, while taking the policy rate to its highest range since 2007. Inflation in the US reached 9 percent annually in June, the highest level since 1981, and then finally fell to 7.1 percent in November.